Explore Reedy Creek, NC FHA Loan Closing Cost Calculator

Using a mortgage closing costs calculator aids in approximating your overall closing expenditures. The estimates provided serve purely illustrative and educational purposes. Our Mortgage closing costs calculator offers insights into your unique financial circumstances, enabling you to comprehend the breakdown of closing expenses.

How to use the Reedy Creek, NC FHA Loan Closing Cost Calculator?

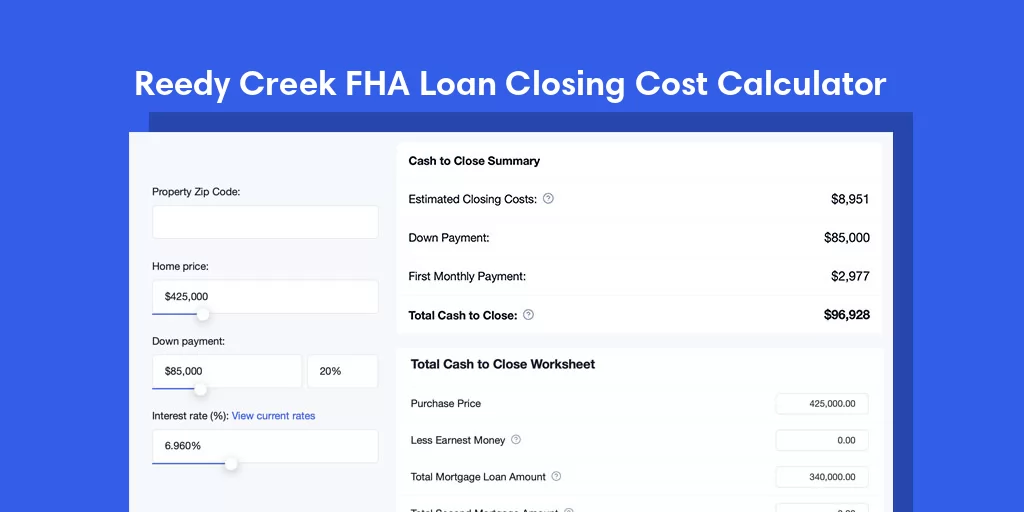

With the MintRates Reedy Creek, NC FHA Loan Closing Cost Calculator, you can input a whole bunch of different numbers and see where they lead you. Follow the steps below:

- Enter your Property Zip Code

- Enter your Home Price

- Enter your Down Payment

- Enter your Mortgage Interest Rate (by default it shows today's Mortgage Rates*).

- Select a loan term (Years): 30 Years, 20 years, or 15 Years scenario

- In seconds, Reedy Creek, NC FHA Loan Closing Cost Calculator will have an estimate of the monthly overview of your monthly payment, including principal and interest — and the additional payments, like Property taxes, Homeowners insurance, and condo/HOA fee if you provide that. The more info you can provide, the more accurate the Total Monthly Payment result will be.

- Scroll down to see the table with closing costs to "Total estimated cash to close" to explore the worksheet with detailed information and Total estimated cash to close.

- Click the "Download in PDF" button to save the PDF file with Report.

The Reedy Creek, NC FHA Loan Closing Cost Calculator Basic inputs

Using a mortgage closing cost calculator can help you quickly and accurately predict your closing cost expenses with just a few pieces of information. It can also show you details of fees. To use this closing cost calculator, you’ll need the following information:

Home price — The dollar amount you expect to pay for a home.

Down payment — Money paid for a house from one’s funds at closing. The down payment will be the difference between the purchase price and the mortgage amount.

Mortgage Interest Rate (%) — The periodic charge, expressed as a percentage, for the use of credit.

Mortgage period (years) — This is the length of time you choose to pay off your loan (e.g., 30 years, 20 years, 15 years, etc.)

The Reedy Creek, NC FHA Loan Closing Cost Calculator advanced inputs

Property tax — A government tax based on the market value of a property.

Home insurance — Home insurance or homeowners insurance is typically required by lenders. You can edit this number in the mortgage calculator's advanced options.

HOA Fee — Owners of condos or townhomes are required to pay homeowners association dues (known as HOA fees), to cover common amenities or services within the property such as garbage collection, landscaping, snow removal, pool maintenance, and hazard insurance.

Understanding the Estimated Cost of Closing Fees Worksheet

Underwriting and Processing Fee: This fee covers the cost of reviewing and processing your mortgage application.

Origination Fee: The origination fee encompasses administrative expenses related to setting up your mortgage.

Credit Report: This fee pertains to obtaining your credit report to assess your creditworthiness.

Appraisal(s) Fees: Appraisal fees cover the cost of evaluating the property's value.

Flood Certification: This fee is for determining if the property is located in a flood zone.

Tax Service Fee: The tax service fee covers the expense of monitoring property tax payments.

Title Search and Lender's Title Insurance: These costs include researching the property's title and obtaining lender's title insurance.

Owner's Title Insurance Policy: This policy safeguards your property ownership rights and interests.

Closing / Escrow / Settlement: This fee accounts for the services provided during the closing process.

Recording Fee Mortgage: The recording fee for the mortgage documents with the appropriate government office.

Recording Fee Deed: The cost associated with recording the property deed.

State Mortgage Tax / Stamps: State-imposed taxes or fees on the mortgage transaction.

Transfer Tax: A tax levied when the property ownership transfers.

Survey: The expense of conducting a property survey to establish boundaries and dimensions.

Understanding the Estimated Cost of Prepaids and Escrow Worksheet

Prepaid Interest: This involves paying the interest on your mortgage for a specific number of days before your first regular monthly payment is due. The calculator considers the number of days and calculates the cost per day.

Escrow Property Taxes: This represents the amount needed to fund your property taxes, usually for a set number of months. The calculator factors in the months and calculates the required amount.

Insurance Escrow: Insurance escrow covers homeowners' insurance costs for a certain number of months. The calculator includes this and calculates the total.

Total Estimated of Prepaids and Escrow: This summarizes the combined amount of prepaid interest, escrow for property taxes, and insurance escrow, providing you with an estimate of these upfront expenses.

Our Reedy Creek, NC FHA Loan Closing Cost Calculator helps you understand and anticipate these prepaid and escrow-related costs, offering a clearer picture of your overall closing expenses.

Understanding the Estimated Cash to Close Summary

Estimated Closing Costs = Cost of Closing Fees + Cost of Prepaids and Escrow / Reserves

How to use Reedy Creek, NC FHA Loan Closing Cost Calculator lenders comparison section

When considering a mortgage, understanding the various lenders' rates, Annual Percentage Rate (APR), monthly payments, and associated fees is crucial for making an informed decision.

Mortgage Rates: This is the interest rate charged by lenders for borrowing money to purchase a home. Rates can vary significantly between lenders, so it’s essential to shop around to find the best option.

APR: The Annual Percentage Rate includes the interest rate plus any additional fees and costs associated with securing the mortgage. This gives a more accurate picture of the true cost of borrowing and allows for better comparisons between lenders.

Monthly Payment: This represents the amount you will pay each month over the term of the loan, based on the loan amount, interest rate, and loan term. Calculating your monthly payment helps you understand how much you can afford.

Fees: These can include origination fees, application fees, appraisal fees, and closing costs. It's important to review these fees as they can add to the overall cost of the mortgage.

By analyzing the Reedy Creek, NC FHA Loan Closing Cost Calculator Results with the rate table, borrowers can evaluate their options, compare costs, and choose a lender that aligns with their financial goals.