When it comes to purchasing a home, understanding your financial obligations is crucial. A mortgage calculator can be your ally in this process, helping you estimate your monthly payments and gain insights into the intricate web of expenses that come with homeownership. In this guide, we’ll delve into the intricacies of a mortgage calculator, breaking down its components and providing you with a step-by-step walkthrough to make the most of it.

Why Use a Mortgage Calculator?

Mortgage calculators serve as invaluable tools for prospective homebuyers. They empower you to predict your monthly mortgage payment and plan your finances accordingly. By inputting various parameters, you can gain a comprehensive view of your potential expenses, including:

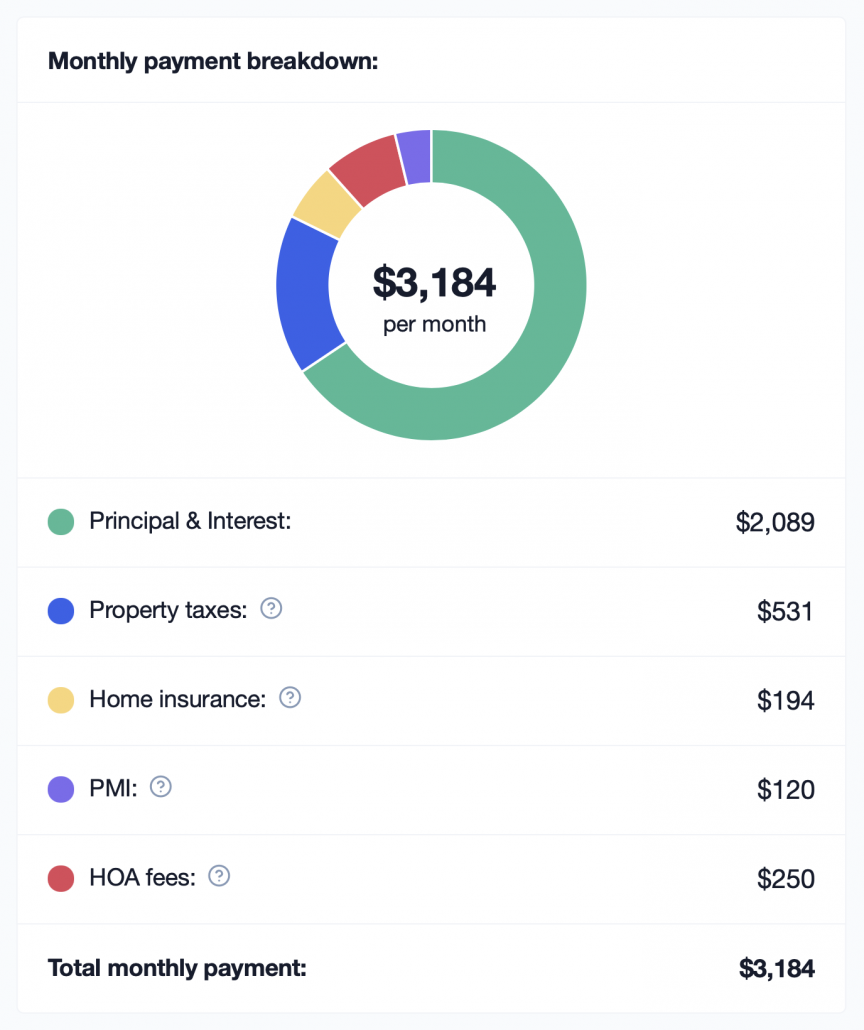

- Principal and Interest: The core components of your mortgage payment. ‘Principal’ refers to the amount that goes towards reducing the loan balance, while ‘Interest’ covers the cost of borrowing.

- Property Taxes: Estimating the monthly amount reserved for property taxes, which contribute to local public services and community amenities.

- Home Insurance: Project the monthly cost of insuring your property against damages, theft, and accidents.

- PMI (Private Mortgage Insurance): An additional cost for those with down payments less than 20% of the home’s value, designed to protect the lender in case of default.

- HOA (Homeowners Association) Fees: If your property is part of an HOA, this accounts for monthly dues that contribute to maintaining communal areas and amenities.

Using the MintRates Mortgage Calculator: Step-by-Step Guide

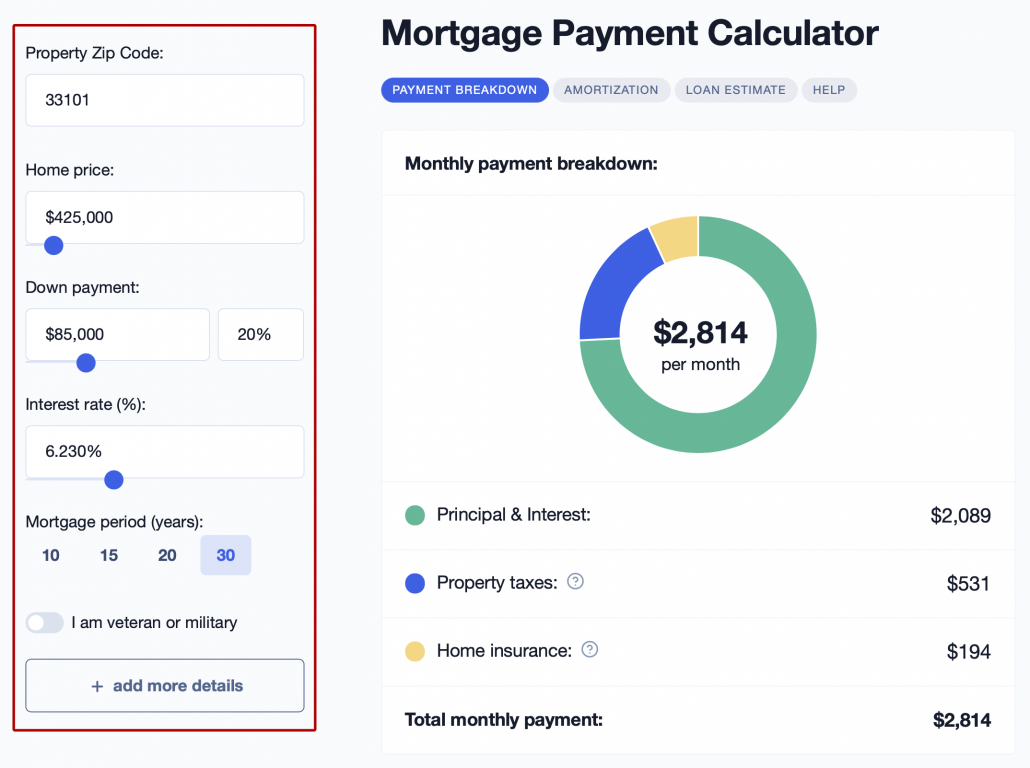

Enter Home Details:

- Start by entering your Property Zip Code.

- Enter the Home Price, which represents the anticipated cost of the property.

- Specify your Down Payment, the difference between the purchase price and the mortgage amount.

- Enter the Mortgage Interest Rate, which can be today’s rate by default.

- Choose a loan term from the options provided (30 Years, 20 Years, or 15 Years).

The calculator will quickly generate an estimate of your monthly payment, incorporating principal, interest, property taxes, homeowners insurance, and potential condo/HOA fees.

Exploring Details:

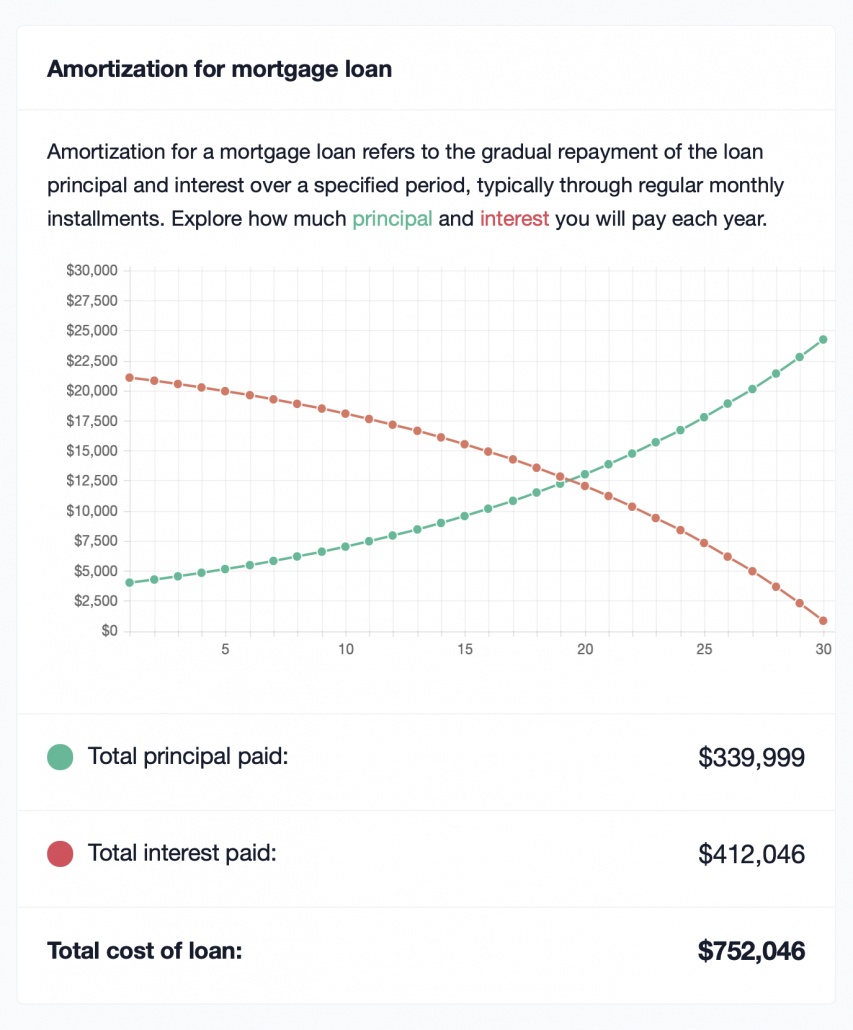

Navigate to the ‘Amortization’ tab to view Loan Amortization graphics and explore payment breakdowns.

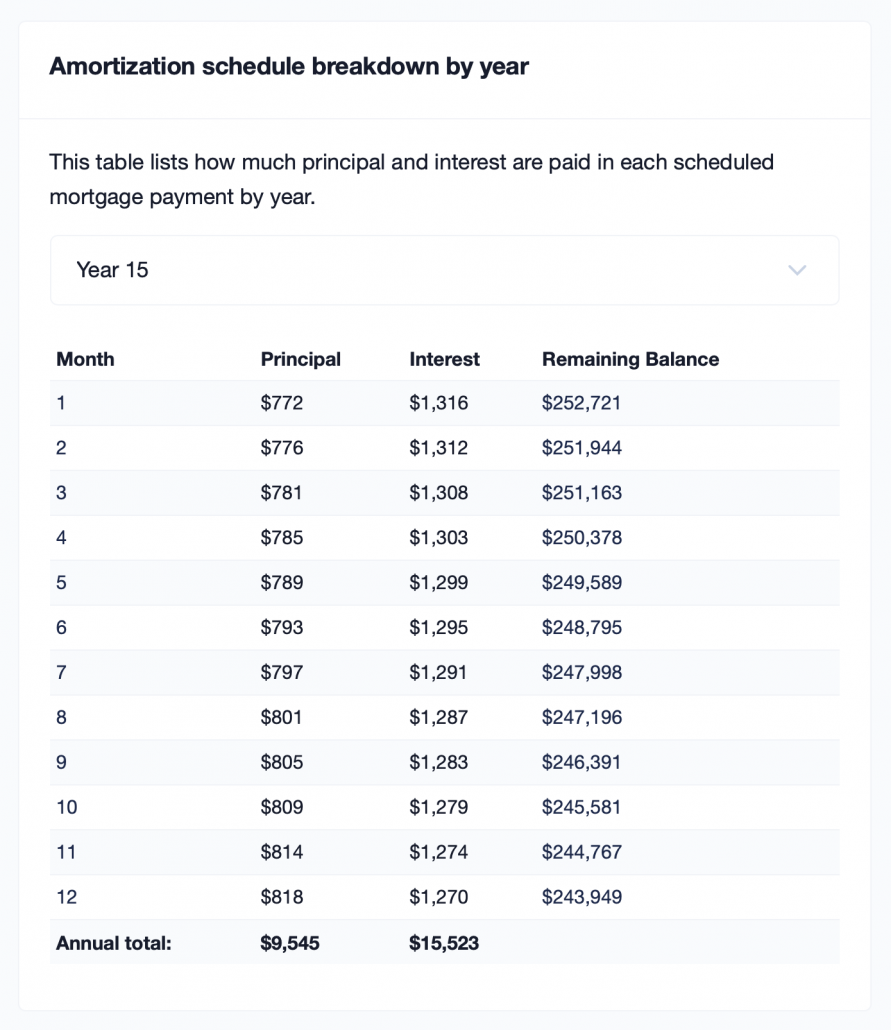

Scroll further to see the ‘Amortization Schedule Breakdown by Year,’ revealing the payment schedule for each year of your chosen term.

Understanding Loan Amortization

Loan amortization refers to the process of gradually paying off a loan, such as a mortgage or an installment loan, through a series of regular payments. These payments are typically made monthly but can also be made quarterly or annually, depending on the terms of the loan. The payments consist of both principal and interest portions, and over time, the proportion of each payment that goes toward the principal gradually increases while the interest portion decreases.

Here’s a detailed breakdown of how loan amortization works:

1. Loan Structure: When you take out a loan, the total amount you borrow is known as the principal. The lender charges you interest for the privilege of borrowing this money. The interest rate and loan term (number of years) play a crucial role in determining the size of your monthly payments and the overall cost of the loan.

2. Monthly Payments: Each month, you make a fixed payment to the lender, which is calculated to cover both the interest accrued on the remaining balance and a portion of the principal. In the early stages of the loan, a larger portion of your payment goes toward paying off the interest, and a smaller portion reduces the principal. As time goes on, the balance shifts and more of your payment is applied to the principal.

3. Principal Reduction: As you make payments over time, the outstanding principal balance gradually decreases. This reduction is the result of the portion of each payment that goes toward the principal. Since the interest is calculated based on the remaining principal balance, as the balance decreases, the interest portion of the payment also decreases.

4. Interest Calculation: The interest for each period (usually a month) is calculated based on the remaining outstanding principal. The interest rate and the number of days in the payment period determine the interest amount. In the beginning, when the principal balance is higher, the interest portion of the payment is larger. As the principal decreases, so does the interest amount.

5. Impact of Extra Payments: If you make additional payments beyond your regular monthly payment, those extra payments go directly toward reducing the principal. This can have a significant impact on the overall loan term and the total interest paid. By paying extra, you effectively accelerate the amortization process and save money on interest.

6. Amortization Schedule: An amortization schedule is a table that provides a detailed breakdown of each monthly payment over the life of the loan. It includes columns for the payment number, payment date, beginning balance, payment amount, interest paid, principal paid, and ending balance. This schedule gives you a clear picture of how your loan will be paid off over time and how much of each payment goes toward interest and principal.

7. Loan Completion: As you continue making payments, the outstanding principal balance continues to decrease. Eventually, your payments will reduce the principal to zero, indicating that the loan has been fully paid off. The length of time it takes to reach this point depends on factors such as the loan term, interest rate, and any extra payments made.

In summary, loan amortization is the systematic process of paying off a loan over time through a series of regular payments that cover both principal and interest. It’s a structured approach that ensures borrowers gradually reduce their debt and eventually become debt-free at the end of the loan term. An amortization schedule provides a comprehensive breakdown of each payment’s allocation between interest and principal, helping borrowers track their progress toward loan repayment.

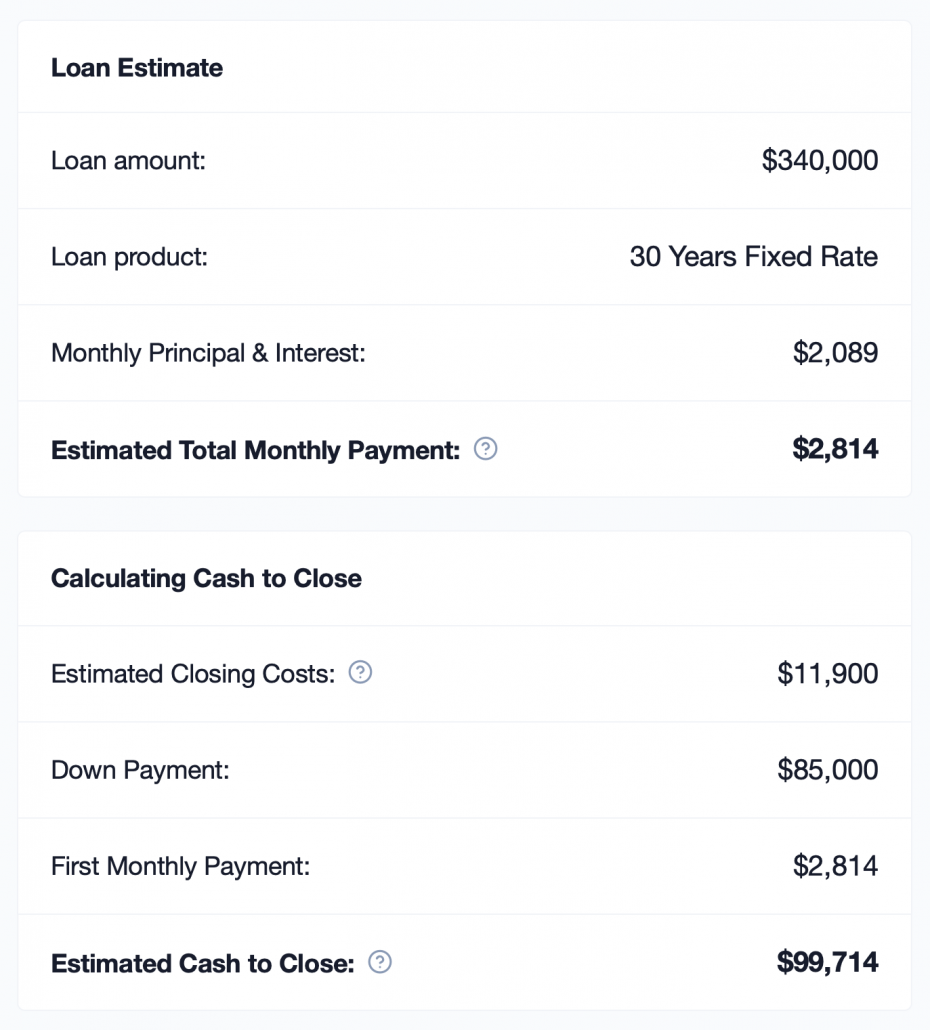

Loan Estimate:

Visit the ‘Loan Estimate’ tab to access summaries of the Total Monthly Payment and Estimated Cash to Close.

Gain insights into the loan amount, loan product, principal and interest, closing costs, down payment, and more.

Here’s an explanation for each line related to Loan Estimate details:

Loan Amount: represents the total sum of money you are borrowing from the lender. This amount is the foundation upon which your mortgage is structured. It’s important to note that this amount is subject to interest and will be paid back over the loan term.

Loan Product: indicates the type of mortgage you’re selecting. In this case, it’s a “30 Years Fixed Rate” loan product. This means that your mortgage will have a fixed interest rate for the entire 30-year duration, ensuring that your monthly payments remain consistent over time.

Monthly Principal & Interest: The “Monthly Principal & Interest” is the core component of your mortgage payment. The “Principal” portion goes towards reducing the loan balance, while the “Interest” covers the cost of borrowing the money. Throughout the loan, the proportion of your payment dedicated to principal and interest will change. In the beginning, a larger portion goes towards interest, while later, more goes toward the principal.

Estimated Total Monthly Payment: The “Estimated Total Monthly Payment” is the comprehensive sum you’ll pay each month. It includes not only the principal and interest but also additional costs like property taxes, home insurance, and, if applicable, Private Mortgage Insurance (PMI) and Homeowners Association (HOA) fees. Understanding this figure gives you a complete picture of your monthly housing expenses.

Estimated Closing Costs: The “Estimated Closing Costs” encompass various expenses associated with the closing of your mortgage. These may include fees for services like appraisals, title searches, credit reports, and legal fees. The estimate helps you anticipate the financial commitment required at the time of closing.

Down Payment: The “Down Payment” is the initial cash amount you contribute towards the home’s purchase. It’s a percentage of the total purchase price, and a larger down payment reduces the loan amount and associated interest costs. It’s an essential factor in determining your loan terms and monthly payments.

First Monthly Payment: The “First Monthly Payment” refers to the sum needed at the start of your mortgage journey. It might include the portion of the interest for the month your loan begins, along with any applicable escrow payments. It’s the initial installment you pay after the closing of your mortgage.

Estimated Cash to Close: The “Estimated Cash to Close” provides an overview of the total amount you’ll need to bring to the closing table. This amount includes not only your down payment but also closing costs and prepaid items like property taxes and insurance. It’s essential to have this amount available at closing to finalize the purchase of your home.

In conclusion, understanding each line in your loan details is crucial for comprehending the various aspects of your mortgage. These elements collectively shape your financial obligations, influence your monthly payments, and determine the overall cost of your homeownership journey. It’s advisable to review these details carefully and seek professional guidance if needed to make informed decisions.

Beyond Basic Uses: Leveraging the Calculator

- Scenario Analysis: Experiment with different inputs to predict payment variations.

- Expense Breakdown: Understand how your payment is divided into principal, interest, taxes, insurance, and fees.

- Loan Type Comparison: Estimate costs for different loan types.

List of Mortgage Calculators available at MintRates.com

- Conventional Mortgage Calculator

- FHA Loan Mortgage Calculator

- VA Loan Mortgage Calculator

- Condo Loan Mortgage Calculator

- Jumbo Loan Mortgage Calculator

Mortgage Calculators by State:

- Alabama Mortgage Calculator

- Alaska Mortgage Calculator

- Arizona Mortgage Calculator

- Arkansas Mortgage Calculator

- California Mortgage Calculator

- Colorado Mortgage Calculator

- Connecticut Mortgage Calculator

- Delaware Mortgage Calculator

- Florida Mortgage Calculator

- Georgia Mortgage Calculator

- Hawaii Mortgage Calculator

- Idaho Mortgage Calculator

- Illinois Mortgage Calculator

- Indiana Mortgage Calculator

- Iowa Mortgage Calculator

- Kansas Mortgage Calculator

- Kentucky Mortgage Calculator

- Louisiana Mortgage Calculator

- Maine Mortgage Calculator

- Maryland Mortgage Calculator

- Massachusetts Mortgage Calculator

- Michigan Mortgage Calculator

- Minnesota Mortgage Calculator

- Mississippi Mortgage Calculator

- Missouri Mortgage Calculator

- Montana Mortgage Calculator

- Nebraska Mortgage Calculator

- Nevada Mortgage Calculator

- New Hampshire Mortgage Calculator

- New Jersey Mortgage Calculator

- New Mexico Mortgage Calculator

- New York Mortgage Calculator

- North Carolina Mortgage Calculator

- North Dakota Mortgage Calculator

- Ohio Mortgage Calculator

- Oklahoma Mortgage Calculator

- Oregon Mortgage Calculator

- Pennsylvania Mortgage Calculator

- Rhode Island Mortgage Calculator

- South Carolina Mortgage Calculator

- South Dakota Mortgage Calculator

- Tennessee Mortgage Calculator

- Texas Mortgage Calculator

- Utah Mortgage Calculator

- Vermont Mortgage Calculator

- Virgin Islands Mortgage Calculator

- Virginia Mortgage Calculator

- Washington Mortgage Calculator

- West Virginia Mortgage Calculator

- Wisconsin Mortgage Calculator

- Wyoming Mortgage Calculator