Aspiring homeowners in 2023 have various options to explore, and one popular choice is an FHA loan. The Federal Housing Administration (FHA) offers mortgage programs that provide flexibility and accessibility to individuals who may face challenges in qualifying for conventional mortgages. In this article, we will delve into the FHA loan requirements and explore the prevailing FHA mortgage rates in 2023.

To secure an FHA loan, it’s important to understand the key requirements set forth by the FHA. While they may evolve, here are some general prerequisites for obtaining an FHA loan:

- Credit Score: A minimum credit score of 580 is typically required to qualify for the low down payment advantage of 3.5%. However, borrowers with credit scores between 500 and 579 may still be eligible, but they may need to provide a larger down payment (typically 10%).

- Debt-to-Income Ratio: Lenders generally prefer a debt-to-income ratio (DTI) of 43% or lower. This means that your total monthly debt payments, including your mortgage, should not exceed 43% of your gross monthly income.

Debt-to-income ratio (DTI) Calculator - Employment History: Demonstrating a stable employment history is crucial. Most lenders prefer at least two years of consistent employment, though exceptions may be made for recent graduates or those with extenuating circumstances.

- Down Payment: FHA loans are known for their low down payment requirements. In 2023, borrowers are typically required to contribute a minimum of 3.5% of the home’s purchase price. This is significantly lower than the 20% typically required for conventional mortgages.

- Mortgage Insurance Premiums: FHA loans require both an upfront mortgage insurance premium (MIP) and an annual MIP. These premiums help protect lenders in case of default. It’s important to factor in these costs when considering the affordability of an FHA loan.

FHA Mortgage Rates in 2023

Mortgage rates are influenced by various factors, including economic conditions, market trends, and the Federal Reserve’s monetary policies. While we cannot predict specific rates for 2023, it’s helpful to understand that FHA mortgage rates are typically influenced by the same factors that impact conventional mortgage rates.

Historically, FHA mortgage rates have been slightly higher than those for conventional loans. However, FHA loans still offer attractive rates compared to alternative loan options, especially for borrowers with lower credit scores or smaller down payments.

Current FHA Mortgage Rates

To get accurate and up-to-date information on FHA mortgage rates in 2023, it’s recommended to reach out to FHA-approved lenders or consult reputable financial institutions. They can provide personalized rate quotes based on your unique financial situation and the prevailing market conditions at the time of your loan application.

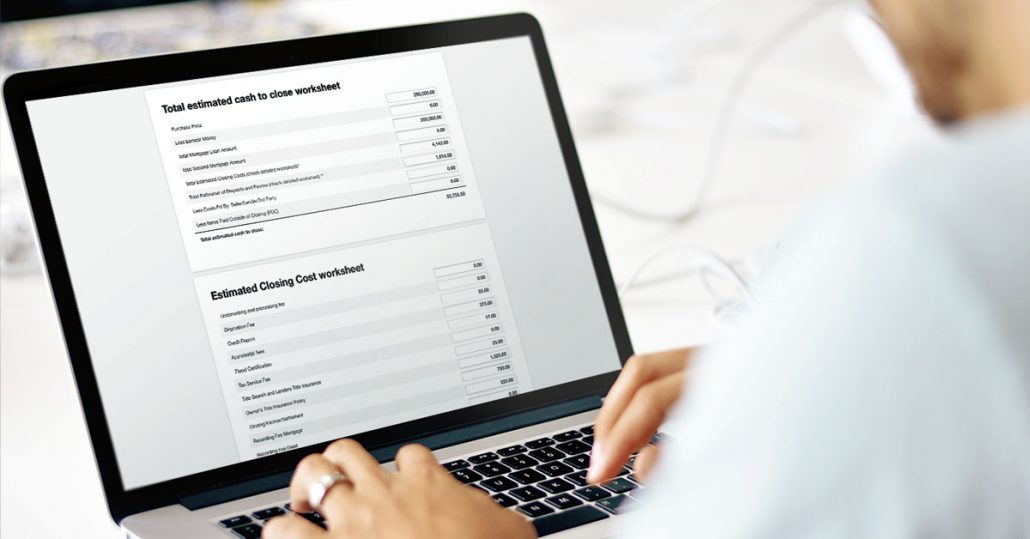

Understanding FHA Loan Closing Costs

FHA loan closing costs encompass the various fees and expenses that borrowers must account for when finalizing their mortgage transaction through the Federal Housing Administration (FHA) loan program. These costs play a crucial role in facilitating a smooth loan approval and closing process, covering essential services and administrative tasks.

Here’s an in-depth look at the key components of FHA loan closing costs:

- Upfront Mortgage Insurance Premium (UFMIP): This is a one-time fee that can be paid upfront in cash or added to the loan amount. It represents a percentage of the loan and contributes to the FHA’s insurance fund, safeguarding lenders in case of default.

- Annual Mortgage Insurance Premium (MIP): An ongoing monthly fee, MIP is divided into installments and included in your mortgage payment. Similar to UFMIP, it helps fund the FHA’s insurance program.

- Appraisal Fees: An appraisal is essential to determine the property’s value. Borrowers are typically responsible for covering the appraisal cost, ensuring that the property’s value aligns with the loan amount.

- Credit Report Fees: Lenders pull your credit report to assess your creditworthiness. This fee covers the expense of obtaining your credit history.

- Origination Fees: Lenders may charge an origination fee, which encompasses various loan processing, underwriting, and administrative tasks associated with your application.

- Title and Escrow Fees: These fees account for services related to title searches, title insurance, and escrow accounts, ensuring a seamless transfer of ownership.

- Recording Fees: Associated with documenting the mortgage and related documents with local government authorities, recording fees are a necessary part of the closing process.

- Prepaid Expenses: This category includes payments for property taxes, homeowner’s insurance, and prepaid interest, often required to be paid in advance.

- Home Inspection Fees: While not mandatory under FHA guidelines, some borrowers opt for a home inspection to identify potential issues before finalizing the transaction.

- Additional Fees: Other potential fees might include charges for document preparation, courier services, and more.

Remember, FHA allows certain closing costs to be rolled into the loan amount, reducing the immediate out-of-pocket burden for borrowers. It’s crucial to discuss these options with your lender and thoroughly review the loan estimate to gain a comprehensive understanding of the breakdown of closing costs.

When considering an FHA loan, borrowers should account for closing costs alongside the down payment requirement and monthly mortgage payments. Seeking guidance from a mortgage professional can provide clarity on the specific closing costs associated with your FHA loan application.

The bottom line

An FHA loan can be a valuable tool for homebuyers in 2023, offering more accessible homeownership opportunities with flexible requirements. By understanding the FHA loan requirements, such as credit scores, DTI ratios, and down payments, prospective buyers can navigate the process more effectively.

Additionally, staying informed about FHA mortgage rates is crucial for making informed decisions. Monitoring market trends and seeking guidance from FHA-approved lenders will ensure you have accurate information about rates that can impact your mortgage’s affordability.

Remember, specific FHA loan requirements and mortgage rates may vary, so it’s advisable to consult with professionals and explore multiple lending options to find the best fit for your financial goals and circumstances. With thorough research and careful planning, you can seize the benefits of an FHA loan and take steps toward achieving your dream of homeownership in 2023.

Helpful links: