In a climate of rising interest rates, investors are presented with an opportune moment to explore investment avenues that can generate stable returns. One such option is investing in US Treasury bonds. These government-issued securities offer a range of benefits when interest rates are high. This article delves into the advantages of buying US Treasury bonds during periods of elevated interest rates and how they can serve as a valuable addition to an investment portfolio.

Stability and Security

US Treasury bonds are renowned for their stability and security. When interest rates are high, investing in these bonds provides an attractive proposition for risk-averse individuals seeking a safe haven for their funds. Backed by the full faith and credit of the United States government, these bonds offer an unparalleled level of security, assuring investors that their principal amount will be returned at maturity, along with the promised interest payments.

Higher Yield and Income

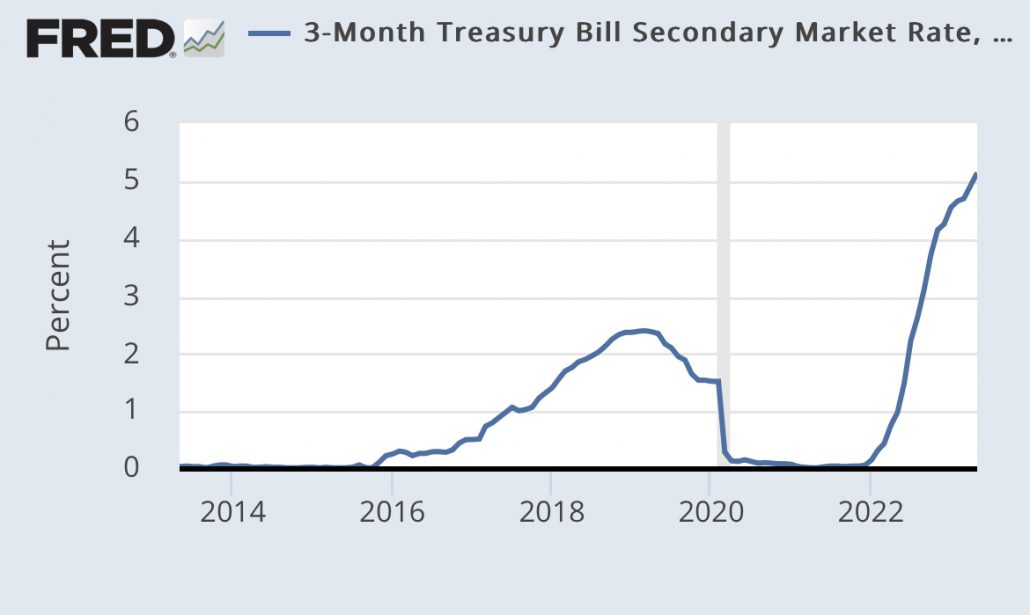

Investing in US Treasury bonds when interest rates are high allows individuals to secure bonds with higher yields. As interest rates rise, newly issued bonds offer more attractive coupon rates, resulting in increased income for bondholders. By buying these bonds during periods of high-interest rates, investors can lock in these elevated yields, generating a consistent income stream throughout the bond’s term.

Diversification and Risk Mitigation

US Treasury bonds play a vital role in diversifying an investment portfolio. While stocks and other higher-risk assets may experience volatility during periods of rising interest rates, bonds provide stability and act as a counterbalance. By investing in Treasury bonds, investors can mitigate risk and potentially offset losses from other investments, creating a well-rounded portfolio that can weather market fluctuations.

Capital Preservation

When interest rates are high, investing in US Treasury bonds allows individuals to preserve their capital. With the assurance of principal repayment at maturity, these bonds offer a lower-risk investment option compared to other assets. This is particularly beneficial for conservative investors or those nearing retirement who prioritize capital preservation and seek to safeguard their wealth against market uncertainties.

Liquidity and Accessibility

US Treasury bonds provide investors with high levels of liquidity and accessibility. They can be easily bought and sold in the secondary market, allowing individuals to access their funds when needed. Furthermore, Treasury bonds are available in various denominations, making them accessible to a wide range of investors, from individual savers to institutional players. This accessibility enhances the flexibility and convenience of investing in these bonds.

A Guide to Buying US Treasury Bonds for Individuals

Discover the steps to buy US Treasury bonds as an individual investor and explore the benefits of this secure investment option.

- Research and Understanding: Educate yourself about the different types of US Treasury bonds, such as Treasury bills, notes, and bonds. Understand their maturities, coupon rates, and yield. Research the current market conditions and interest rates to make informed investment decisions.

- Determine Your Investment Goals: Define your investment goals to align with the appropriate type of Treasury bond. Are you seeking short-term liquidity with Treasury bills or long-term stability with Treasury bonds? Consider factors such as income generation, capital preservation, and diversification.

- Open a TreasuryDirect Account: To purchase US Treasury bonds, open an account on the TreasuryDirect website, which is the official platform for individual investors. Provide your personal information, including your Social Security number, and follow the steps to set up your account.

- Decide on Bond Purchase: Choose the specific Treasury bond you want to buy based on your research and investment goals. Consider factors such as maturity, coupon rate, and yield. Select the desired amount to invest and proceed to the purchase stage.

- Funding Your Account: To fund your TreasuryDirect account, you have several options. You can link your bank account for direct transfers or use your tax refunds or other eligible federal payments to purchase bonds. Ensure you have sufficient funds to cover the investment amount.

- Place Your Order: Once your TreasuryDirect account is funded, place your order for the selected Treasury bond. Specify the desired amount and confirm the transaction details. Review and ensure accuracy before submitting the order for processing.

- Managing and Monitoring: After purchasing Treasury bonds, actively manage and monitor your investments. Keep track of coupon payments, maturity dates, and changes in interest rates. Consider reinvesting coupon payments or developing a strategy to maximize returns.

The bottom line

Investing in US Treasury bonds while interest rates are high can be a prudent strategy for individuals seeking stability, income, and capital preservation. These bonds offer security, higher yields, diversification benefits, and liquidity, making them an attractive addition to an investment portfolio. By capitalizing on periods of elevated interest rates, investors can position themselves for financial success, knowing that their funds are in trusted hands backed by the United States government.