Explore Explore Mountain Home, UT USDA Loan Mortgage Calculator with property taxes and homeowners insurance, PMI, and HOA

The Mountain Home, UT USDA Loan Mortgage Calculator is an invaluable tool designed to empower potential homebuyers with the information needed to make informed financial decisions. The USDA (United States Department of Agriculture) loan is a unique mortgage option that supports rural homeownership by offering low interest rates and zero down payment requirements. The Mountain Home, UT USDA Loan Mortgage Calculator takes into account various factors, providing a detailed estimate of your monthly mortgage expenses. Here’s a comprehensive guide to understanding and using the Mountain Home, UT USDA Loan Mortgage Calculator.

Key Features:

- Calculate Monthly Mortgage Payments: Estimate your monthly payment for a USDA loan, considering factors such as loan amount, interest rate, property taxes, homeowners insurance, and any applicable mortgage insurance.

- Zero Down Payment: Unlike many traditional loans, USDA loans offer the benefit of zero down payment, making homeownership more accessible for qualified borrowers in rural areas.

- Account for Mortgage Insurance: USDA loans typically require a guarantee fee, which acts similarly to mortgage insurance. The calculator helps you understand how this fee affects your monthly payment.

- Consider Property Location: The USDA loan is specifically designed for homes in eligible rural areas. The calculator considers the property location to ensure accuracy in estimating taxes and insurance costs.

How to Use the Mountain Home, UT USDA Loan Mortgage Calculator:

Using the Mountain Home, UT USDA Loan Mortgage Calculator is a straightforward process. Follow these steps:

- Enter Property Location: Specify the location of the property to determine its eligibility for a USDA loan.

- Enter Loan Amount: Input the amount you intend to borrow.

- Enter USDA Loan Interest Rate: Provide the current interest rate or use the default rate displayed.

- Select Loan Term: Choose the loan term (e.g., 30 years, 20 years, or 15 years) that aligns with your financial goals.

- Include Property Taxes and Homeowners Insurance: Enter the estimated property taxes and homeowners insurance costs. These vary by location and property value.

- Understand USDA Guarantee Fee: The USDA charges a guarantee fee, which functions similarly to mortgage insurance. The calculator incorporates this fee into your overall payment estimate.

- Review Results: In seconds, the calculator provides an estimate of your monthly payment, including principal and interest, property taxes, homeowners insurance, and the USDA guarantee fee.

- Explore Additional Tabs: Explore tabs like “Amortization” to visualize your loan payment schedule and “Loan Estimate” for a comprehensive summary.

Understanding Mountain Home, UT USDA Loan Mortgage Calculator Inputs:

To use the calculator effectively, you need to understand and input the following information:

- Property Location: Confirm that the property is in an eligible rural area as defined by the USDA.

- Loan Amount: Specify the amount you plan to borrow.

- USDA Loan Interest Rate: Input the current interest rate or use the default rate.

- Loan Term: Choose the loan term that aligns with your financial goals.

- Property Tax: Estimate the annual property tax, which varies based on the property’s location.

- Homeowners Insurance: Provide an estimate for homeowners insurance, which protects your investment in case of damage or theft.

- USDA Guarantee Fee: Factor in the guarantee fee, a unique feature of USDA loans.

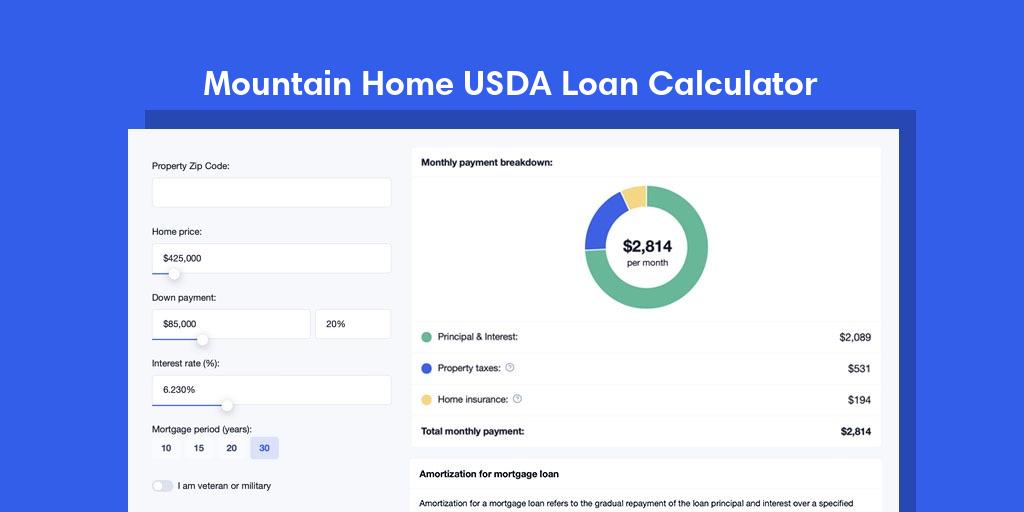

Breakdown of Monthly Payments in the Mountain Home, UT USDA Loan Mortgage Calculator:

Similar to the FHA calculator, the USDA calculator provides a detailed breakdown of monthly payments:

- Principal & Interest: Core components of your payment, with ‘Principal’ reducing the loan balance and ‘Interest’ representing the cost of borrowing.

- Property Taxes: Monthly allocation for property taxes, contributing to local public services.

- Homeowners Insurance: Projected monthly cost to insure the property against damage or theft.

- USDA Guarantee Fee: Similar to PMI, this fee protects the lender in case of default, and it can be factored into your monthly payment.

- Total Monthly Payment: Summarizes the cumulative amount, including principal, interest, property taxes, homeowners insurance, and the USDA guarantee fee.

Tips for Using the Mountain Home, UT USDA Loan Mortgage Calculator:

- Verify Eligibility: Ensure the property is located in an eligible rural area as defined by the USDA.

- Accurate Input: Provide accurate information for property taxes, homeowners insurance, and the USDA guarantee fee for precise estimates.

- Explore Scenarios: Adjust loan amounts, interest rates, and terms to find the best fit for your financial situation.

- Consult Professionals: Seek guidance from a mortgage professional to explore personalized options based on your circumstances.

Notes:

- The calculator provides estimates and may not reflect exact costs.

- USDA loan terms and eligibility may vary based on factors like credit score and income.

- USDA loans offer a unique opportunity for rural homeownership with zero down payment requirements.

- The USDA guarantee fee serves a similar purpose as PMI in protecting the lender.

In conclusion, the Mountain Home, UT USDA Loan Mortgage Calculator is a valuable tool for individuals considering a USDA loan for home purchases. It offers insights into potential monthly mortgage expenses, allowing informed decision-making. Always consult with a qualified mortgage advisor or lender for precise USDA loan terms and eligibility information.