Explore Explore Bonita, AZ Mortgage Calculator with property taxes and homeowners insurance, PMI, and HOA

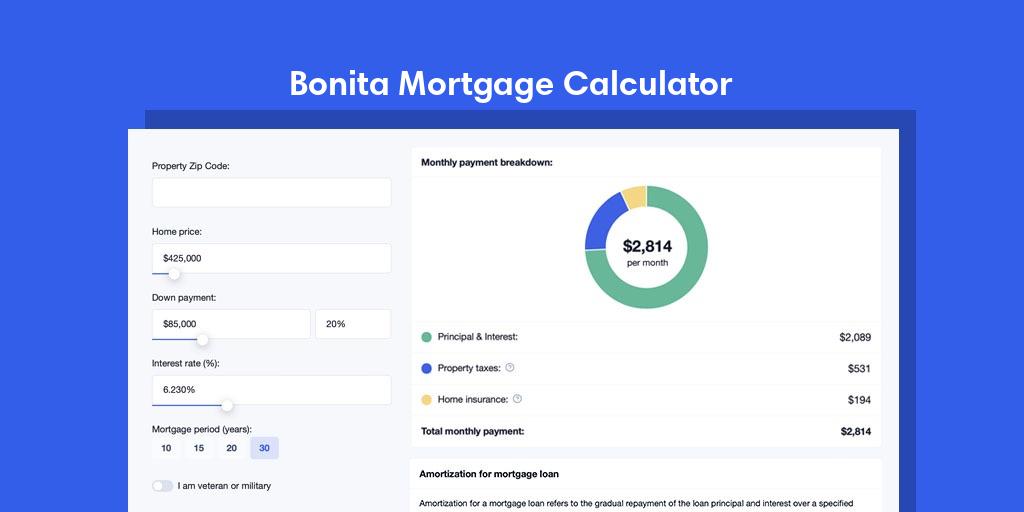

The Bonita, AZ Mortgage Calculator is a versatile tool designed to help you estimate your monthly mortgage payment, taking into account various factors including your loan amount, interest rate, loan term, property taxes, homeowners insurance, Private Mortgage Insurance (PMI), and Homeowners Association (HOA) fees. Whether you’re a prospective homebuyer, refinancing your current mortgage, or just curious about potential costs, this calculator can provide valuable insights into your financial planning.

Key Features:

- Calculate Monthly Mortgage Payments: Determine your estimated monthly payment.

- Include Taxes and Insurance: Factor in property taxes and homeowners insurance costs.

- Account for PMI (if needed): If your down payment is less than 20%, PMI may apply.

- Consider HOA Fees: Calculate the impact of Homeowners Association fees.

- Estimate Your Total Monthly Payment: Get a comprehensive view of your monthly expenses.

How to use the Bonita, AZ Mortgage Calculator with taxes, insurance, PMI, and hoa?

With the Mintrates Advanced Mortgage Payment Calculator, you can input a whole bunch of different numbers and see where they lead you. Follow the steps below:

- Enter your Home Price.

- Enter your Down Payment.

- Enter your Mortgage Interest Rate (by default it shows today’s Mortgage Rates*).

- Select a loan term (Years): 30 Years, 20 years, or 15 Years scenario.

- In seconds, our Bonita, AZ Mortgage Calculator will have an estimate of the monthly overview of your monthly payment, including principal and interest — and the additional payments, like Property taxes Homeowners insurance, and condo/HOA fees if you provide that. The more info you can provide, the more accurate the Total Monthly Payment result will be.

- Click the “Amortization” Tab to see a page with Loan Amortization graphics.

- Scroll down to see the table “Amortization schedule breakdown by year” to explore the Loan Payment Schedule including the Payment schedule for each year of your terms.

- Click the “Download in PDF” button to start downloading the PDF Report.

- Click the “Loan Estimate” tab to explore the summary for Total Monthly Payment and Estimated Cash to Close.

Of course, these are all estimates. But this is an excellent first step in determining what your mortgage payments might be in a given scenario.

Understand Bonita, AZ Mortgage Calculator Principal and Interest Basic and Advanced Inputs Property Tax, Homeowners Insurance, HOA, PMI

Using an online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. It can also show you the total amount of interest you’ll pay over the life of your mortgage. To use this calculator, you’ll need the following information:

Home price — The dollar amount you expect to pay for a home.

Down payment — Money paid for a house from one’s own funds at closing. The down payment will be the difference between the purchase price and the mortgage amount.

Mortgage Interest Rate (%) — The periodic charge, expressed as a percentage, for the use of credit.

Mortgage period (years) — This is the length of time you choose to pay off your loan (e.g., 30 years, 20 years, 15 years, etc.)

Veteran or Military — Select this checkbox if you are a veteran or currently serving in the military. Choosing this option might make you eligible for special mortgage programs and benefits designed to support veterans and active-duty service members. If you qualify, these programs could potentially offer reduced interest rates, lower down payment requirements, and other financial advantages to help you achieve your homeownership goals.

Property tax — A government tax based on the market value of a property.

Home insurance — Home insurance or homeowners insurance is typically required by lenders. You can edit this number in the mortgage calculator’s advanced options.

HOA Fee — Owners of condos or townhomes are required to pay homeowners association dues (known as HOA fees), to cover common amenities or services within the property such as garbage collection, landscaping, snow removal, pool maintenance, and hazard insurance.

Private Mortgage Insurance (PMI) — This is a type of insurance that lenders often require from homebuyers who make a down payment of less than 20% of the home’s purchase price. PMI is designed to protect the lender in case the borrower defaults on the loan.

Discover the Breakdown of Monthly Payments in the Bonita, AZ Mortgage Calculator:

- Principal & Interest: The ‘Principal & Interest’ amount represents the core components of your mortgage payment. ‘Principal’ refers to the portion of your payment that goes towards reducing the loan balance, while ‘Interest’ is the cost of borrowing the money.

- Property Taxes: The ‘Property Taxes’ line indicates the estimated amount set aside each month to cover property taxes. These taxes contribute to local public services like schools, roads, and other community amenities.

- Home Insurance: Under ‘Home Insurance,’ you’ll find the projected monthly cost to insure your property. Home insurance safeguards your investment by providing coverage in case of damage, theft, or certain accidents.

- PMI (Private Mortgage Insurance): Included in the breakdown is ‘PMI,’ which stands for Private Mortgage Insurance. If your down payment is less than 20% of the home’s value, PMI helps protect the lender. It’s an additional cost that can often be removed once your equity in the property reaches a certain level.

- HOA (Homeowners Association) Fees: The ‘HOA Fees’ line indicates any monthly dues you pay to a Homeowners Association if your property is part of an HOA. These fees can contribute to maintaining common areas, amenities, and shared community expenses.

- Total Monthly Payment: The ‘Total Monthly Payment’ summarizes the cumulative amount you’ll pay each month, encompassing the mortgage’s principal and interest, property taxes, and home insurance. Understanding this figure helps you manage your overall monthly housing expenses.

Navigate the “Loan Amortization tab” in the Bonita, AZ Mortgage Calculator

A complete table of periodic blended loan payments, showing the amount of principal and the amount of interest that comprise each payment so that the loan will be paid off at the end of its term. While each periodic payment is the same, early in the schedule, the majority of each periodic payment is interest. The percentage of each payment that goes toward interest diminishes a bit with each payment and the percentage that goes toward principal increases. Later in the schedule, the majority of each periodic payment is put toward the principal. The last line of the schedule shows the borrower’s total interest and principal payments for the entire loan term.

Navigate the “Loan Estimate” Tab in the Bonita, AZ Mortgage Calculator

- Loan Amount: The ‘Loan Amount’ represents the total funds you’re borrowing for your mortgage. This amount forms the basis for calculating various aspects of your loan and monthly payments.

- Loan Product: Under ‘Loan Product,’ you’ll find the type of mortgage you’re considering. Each loan product has unique features that can impact your payment structure.

- Monthly Principal & Interest: The ‘Monthly Principal & Interest’ section breaks down your basic mortgage payment, consisting of the ‘Principal’ amount (loan balance) and ‘Interest’ (the cost of borrowing). This forms the core of your monthly obligation.

- Estimated Total Monthly Payment: The ‘Estimated Total Monthly Payment’ encompasses not only the principal and interest but also includes additional costs like property taxes, home insurance, and, if applicable, Private Mortgage Insurance (PMI) and Homeowners Association (HOA) fees.

- Estimated Closing Costs: The ‘Estimated Closing Costs’ detail the expenses you’ll likely encounter during the closing process. These costs may cover appraisal fees, title insurance, government taxes, and other charges associated with finalizing your mortgage.

- Down Payment: The ‘Down Payment’ is the initial cash amount you’ll contribute toward the home’s purchase. It affects the loan amount, and your interest rate, and may determine whether you need Private Mortgage Insurance (PMI).

- First Monthly Payment: The ‘First Monthly Payment’ reveals the sum required at the beginning of your mortgage journey. It could include the portion of the interest for the month your loan begins, plus any applicable escrow payments.

- Estimated Cash to Close: The ‘Estimated Cash to Close’ summarizes the total amount you’ll need to bring to the closing table, including the down payment, closing costs, and prepaid items. This gives you an idea of your financial commitment at closing.

Mortgages can be confusing for the first-time home buyer, so let us help explain. To understand the most important lending and mortgage terms find explanations for most of the mortgage industry terms in Mortgage Glossary.

More ways to use our Bonita, AZ Mortgage Calculator

Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. Here are some other uses:

- Calculate different scenarios

- See where your money is going

- Estimate the cost of different loan types

Notes:

- The calculator’s results are estimates and may not reflect the exact costs you’ll incur.

- Your actual mortgage terms and eligibility may vary based on your credit score, income, and other factors.

- PMI is typically required when your down payment is less than 20% of the home’s purchase price.

- HOA fees are specific to properties in planned communities or condominiums and may vary widely.

The Bonita, AZ Mortgage Calculator with Taxes, Insurance, PMI, HOA, and Current Mortgage Rates features is a valuable tool for individuals considering homeownership or refinancing. It provides you with a clearer picture of your potential monthly mortgage expenses, allowing you to make informed financial decisions when purchasing or refinancing a home. Always consult with a qualified mortgage advisor or lender for precise loan terms and eligibility information. Stay informed about current mortgage rates to make well-informed financial choices.

What is next?

After you calculate your Monthly mortgage payment you all need to know how much money you need to bring on closing. Our Mortgage closing costs calculator can help you estimate your total closing expenses. When you work with the mortgage calculator, please remember the dollar amounts displayed aren’t guaranteed, and what you actually pay may be different. The estimates you receive are for illustrative and educational purposes only. A closing costs calculator like ours lets you see closing costs based on the specifics of your financial situation.