When it comes to purchasing a home, one of the essential factors to consider is the mortgage closing cost. This is the sum of expenses you need to pay to finalize your home purchase and secure your mortgage. Understanding these costs and being prepared for them is crucial to ensure a smooth and hassle-free real estate transaction.

Mortgage Closing Cost Calculator: A Valuable Tool

To provide clarity and transparency in the home buying process, the Mintrates Mortgage Closing Cost Calculator is here to help. This comprehensive tool is designed to assist you in estimating the various components that contribute to the cash required for closing on your mortgage.

Using the Closing Cost Calculator: A Step-by-Step Guide

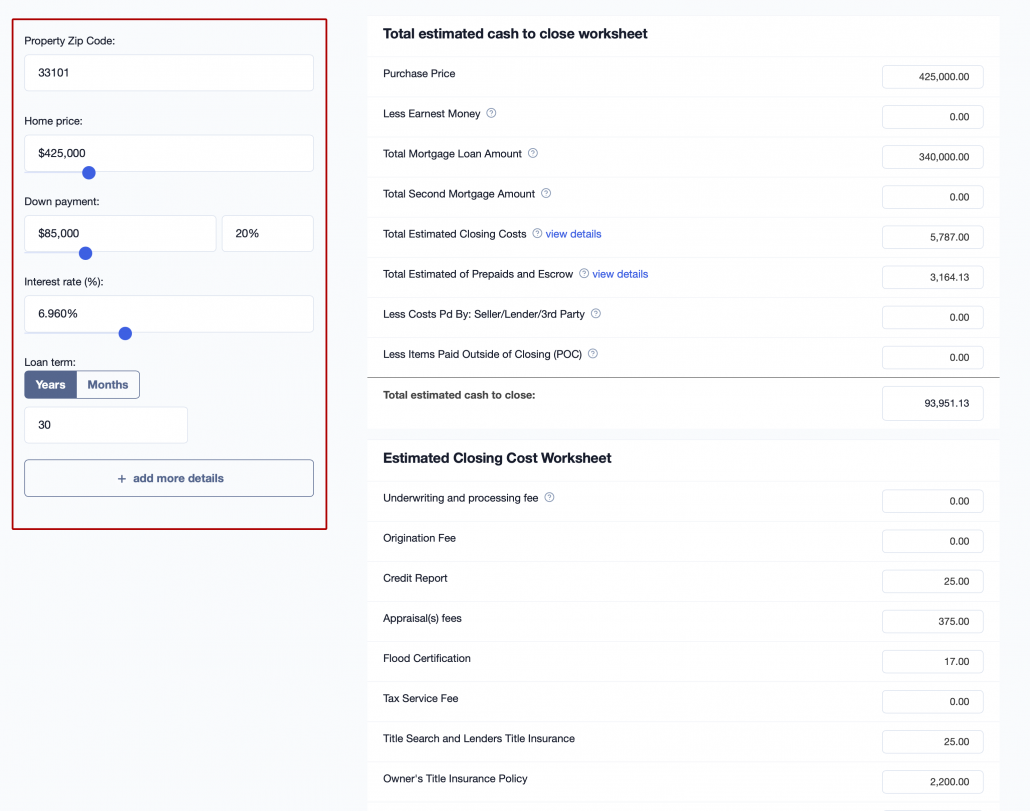

- Enter Your Property Details: Start by inputting key details, including your property’s zip code, home price, down payment, mortgage interest rate, and loan term (e.g., 30, 20, or 15 years).

- Explore the Estimate: In mere seconds, the Mortgage Closing Cost Calculator generates an estimate of your monthly payment. This includes principal and interest, as well as additional payments like property taxes, homeowners insurance, and condo/HOA fees.

- Get a Breakdown: Scroll down to the “Total estimated cash to close worksheet.” Here, you’ll find a detailed breakdown of various elements, such as the purchase price, earnest money, total mortgage loan amount, second mortgage amount, closing costs, prepaid and escrow, costs covered by the seller/lender/3rd party, and more.

- Download a PDF Report: For your convenience, you can download a PDF report that summarizes the information provided by the calculator.

Navigating the Financial Landscape: The Total Estimated Cash to Close Worksheet

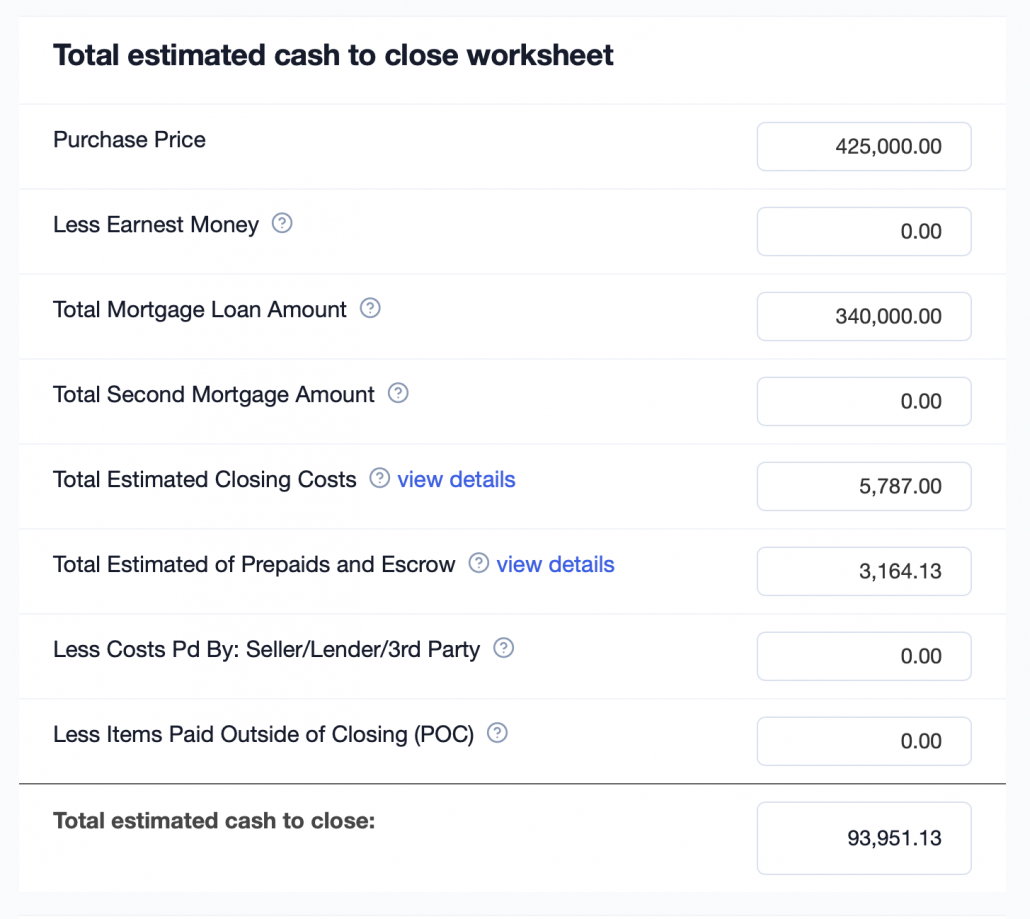

In the realm of mortgage closing, understanding the intricate web of financial components is crucial to ensuring a seamless transition to homeownership. Among the key elements that demand your attention, the “Total Estimated Cash to Close Worksheet” emerges as a pivotal guide. This comprehensive breakdown encompasses various critical factors that play a pivotal role in shaping your closing costs.

Let’s delve into the components of this essential worksheet:

Purchase Price: At the foundation of your mortgage transaction lies the purchase price – the total cost of acquiring your dream home. This amount sets the stage for the entire closing process.

Less Earnest Money: Demonstrating your commitment to the purchase, earnest money serves as a deposit. It’s subtracted from the purchase price, refining the financial landscape.

Total Mortgage Loan Amount: This sum reflects the primary mortgage loan you’ll secure to finance your new home, a fundamental pillar of your home-buying journey.

Total Second Mortgage Amount: If applicable, a second mortgage or home equity loan may be part of the equation, impacting your overall financial outlook.

Total Estimated Closing Costs: A comprehensive view of the amalgamated costs associated with finalizing your mortgage. These costs encompass services provided by various stakeholders in the closing process.

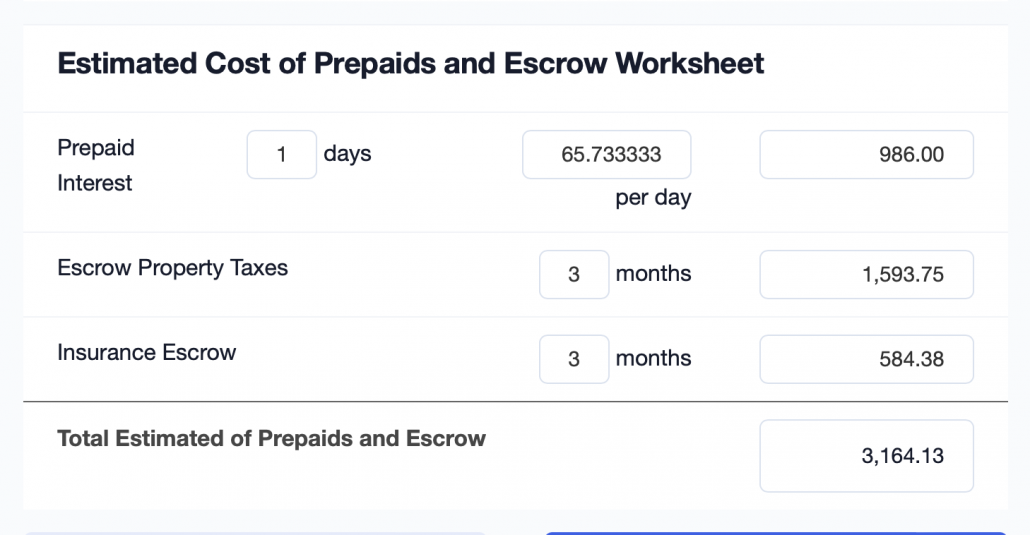

Total Estimated of Prepaids and Escrow: Delving into prepayments and escrow, this category forecasts expenses related to property taxes, homeowner’s insurance, and funds held in escrow.

Less Costs Pd By: Seller/Lender/3rd Party: Acknowledging contributions from sellers, lenders, or third parties in covering certain costs, this facet adds nuance to your financial analysis.

Less Items Paid Outside of Closing (POC): Certain expenses might be settled outside of the closing process, warranting a distinct consideration.

Total Estimated Cash to Close: A culmination of the above components, the total estimated cash to close crystallizes the amount you’ll need to bring to the closing table. This includes your down payment, closing costs, and additional relevant expenditures.

As you embark on your mortgage journey, the “Total Estimated Cash to Close Worksheet” becomes your compass, guiding you through the intricacies of closing costs. Each element converges to provide a clear panorama of your financial responsibilities, fostering a well-informed approach to securing your new abode.

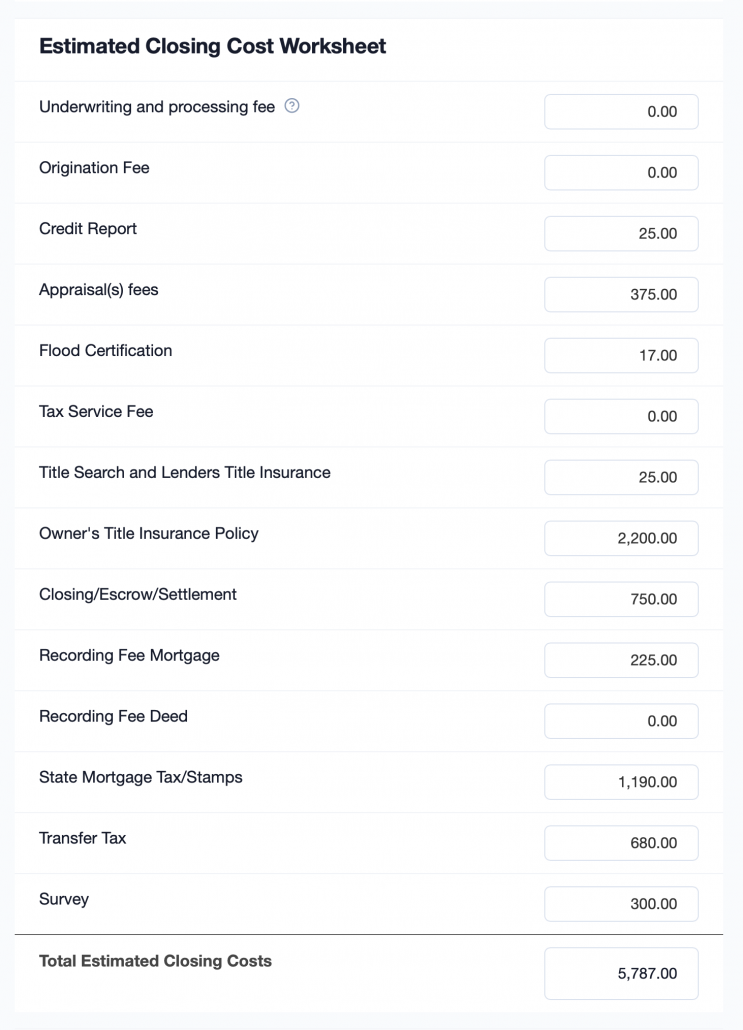

A Closer Look at Closing Costs

Closing costs encompass a range of fees associated with finalizing the mortgage transaction. These costs can include:

Underwriting and Processing Fee: This fee covers the cost of reviewing and processing your mortgage application.

Origination Fee: Encompassing administrative expenses related to setting up your mortgage.

Credit Report Fee: Pertaining to obtaining your credit report to assess your creditworthiness.

Appraisal Fees: Covering the cost of evaluating the property’s value.

Flood Certification Fee: For determining if the property is located in a flood zone.

Tax Service Fee: Covering the expense of monitoring property tax payments.

Title Search and Lender’s Title Insurance: Researching the property’s title and obtaining lender’s title insurance.

Owner’s Title Insurance Policy: Safeguarding your property ownership rights and interests.

Closing/Escrow/Settlement Fee: Accounting for the services provided during the closing process.

Recording Fees: Associated with recording the mortgage documents and property deed.

State Mortgage Tax/Stamps: State-imposed taxes or fees on the mortgage transaction.

Transfer Tax: Levied when property ownership transfers.

Survey Fee: The expense of conducting a property survey to establish boundaries and dimensions.

Understanding Prepaids and Escrow

Prepaid interest, property taxes, and homeowners insurance are essential elements to consider before closing. These costs are often paid upfront:

Prepaid Interest: Pay the interest on your mortgage for a specific number of days before your first regular monthly payment is due.

Escrow Property Taxes: Funding property taxes for a set number of months.

Insurance Escrow: Covering homeowners’ insurance costs for a certain number of months.

Plan Ahead for a Smooth Closing

The Mintrates Mortgage Closing Cost Calculator empowers you to make informed decisions by providing a comprehensive overview of the expenses involved in your home purchase. While the dollar figures displayed are estimates, they serve as valuable insights into your potential costs. Remember, every home purchase is unique, and having a clear understanding of your closing expenses can make the entire process more manageable.

Closing Cost Calculators by State:

- Alabama Closing Cost Calculator

- Arizona Closing Cost Calculator

- Arkansas Closing Cost Calculator

- California Closing Cost Calculator

- Colorado Closing Cost Calculator

- Connecticut Closing Cost Calculator

- Delaware Closing Cost Calculator

- Florida Closing Cost Calculator

- Georgia Closing Cost Calculator

- Idaho Closing Cost Calculator

- Illinois Closing Cost Calculator

- Indiana Closing Cost Calculator

- Iowa Closing Cost Calculator

- Kansas Closing Cost Calculator

- Kentucky Closing Cost Calculator

- Louisiana Closing Cost Calculator

- Maine Closing Cost Calculator

- Maryland Closing Cost Calculator

- Massachusetts Closing Cost Calculator

- Michigan Closing Cost Calculator

- Minnesota Closing Cost Calculator

- Mississippi Closing Cost Calculator

- Missouri Closing Cost Calculator

- Montana Closing Cost Calculator

- Nebraska Closing Cost Calculator

- Nevada Closing Cost Calculator

- New Hampshire Closing Cost Calculator

- New Jersey Closing Cost Calculator

- New Mexico Closing Cost Calculator

- New York Closing Cost Calculator

- North Carolina Closing Cost Calculator

- North Dakota Closing Cost Calculator

- Ohio Closing Cost Calculator

- Oklahoma Closing Cost Calculator

- Oregon Closing Cost Calculator

- Pennsylvania Closing Cost Calculator

- Rhode Island Closing Cost Calculator

- South Carolina Closing Cost Calculator

- South Dakota Closing Cost Calculator

- Tennessee Closing Cost Calculator

- Texas Closing Cost Calculator

- Utah Closing Cost Calculator

- Vermont Closing Cost Calculator

- Virgin Islands Closing Cost Calculator

- Virginia Closing Cost Calculator

- Washington Closing Cost Calculator

- West Virginia Closing Cost Calculator

- Wisconsin Closing Cost Calculator

- Wyoming Closing Cost Calculator

So, whether you’re a first-time homebuyer or an experienced real estate investor, the Mortgage Closing Cost Calculator is your ally in navigating the complex world of closing costs. Use this tool to gain clarity, anticipate expenses, and embark on your homeownership journey with confidence.