The prospect of purchasing a home in a market with high mortgage rates may initially seem daunting to prospective homebuyers. However, there are potential advantages to consider amidst this challenging scenario. When fewer buyers can afford homes due to high borrowing costs, it can lead to more attractive home prices and opportunities for negotiation. In this article, we will explore the benefits of buying a home when mortgage rates are high and how it can work to the advantage of savvy homebuyers.

Lower Competition

When mortgage rates rise, some potential homebuyers may choose to delay their plans or opt to rent instead. This decrease in buyer demand can result in lower competition among home shoppers. With fewer buyers vying for the same properties, homebuyers have a greater chance of finding and securing their desired home without the pressure of multiple competing offers. This reduced competition can provide a more relaxed and focused home-buying experience.

Let’s see examples of monthly payment differences for scenarios:

Example 1: Mortgage Payment for a $500,000 House with a 30-Year Fixed Rate at 6% Interest Rate.

Using a mortgage calculator or spreadsheet software, we can find that the monthly mortgage payment for this scenario is approximately $2,998.87.

Example 2: Mortgage Payment for a $500,000 House with a 30-Year Fixed Rate at 2.5% Interest Rate – monthly mortgage payment for this scenario is approximately $1,975.38.

| Scenarios | Home Price | Rate Term | Interest Rate | Monthly Payment |

|---|---|---|---|---|

| Example 1 | $500,000 | 30-Year Fixed | 6% | $2,998.87 |

| Example 2 | $500,000 | 30-Year Fixed | 2.5% | $1,975.38 |

| Mo payment differences (34.16%): | $1,023.49 | |||

In this example, where the mortgage payment shows a 34.16% increase, it becomes evident that higher interest rates can significantly impact affordability. A substantial rise in monthly mortgage payments translates to fewer potential buyers who can afford to purchase a home with a mortgage. This underscores the importance of securing favorable interest rates to ensure a broader range of prospective homeowners can enter the housing market with confidence

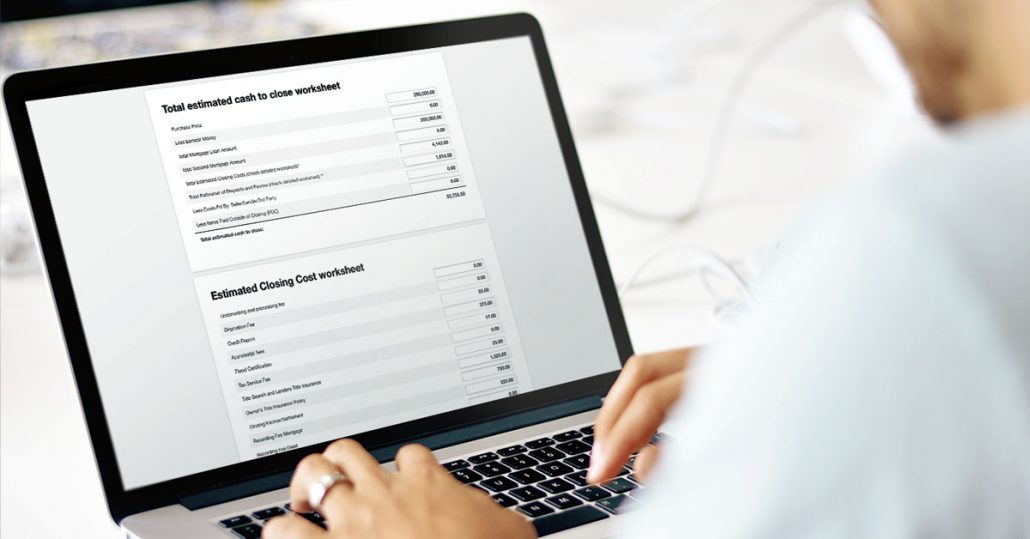

Please note that these calculations do not include additional costs such as property taxes, homeowner’s insurance, or private mortgage insurance (if applicable). It’s important to consider these factors when determining the overall affordability of a mortgage. Use this Mortgage Payment Calculator with taxes and insurance to estimate the total monthly payment.

Increased Bargaining Power

In a market where fewer buyers can afford homes due to high mortgage rates, sellers may be more willing to negotiate and consider offers below the asking price. The reduced competition can give prospective buyers an upper hand when negotiating the purchase price. By leveraging the current market conditions, homebuyers have a greater chance of securing a favorable deal and potentially obtaining a discounted price.

Favorable Pricing and Affordability

High mortgage rates can put downward pressure on home prices, making them more attractive to buyers. Sellers may be motivated to adjust their pricing strategies to entice potential buyers who are facing increased borrowing costs. This situation can lead to more affordable housing options and potentially allow buyers to secure a home that may have been out of reach in a low-rate environment. Taking advantage of these market conditions can provide an opportunity for homeownership at a more reasonable cost.

Potential Long-Term Savings

While high mortgage rates can seem discouraging at first, there is a silver lining when it comes to long-term savings. When interest rates are high, there is a greater chance of rates decreasing in the future. Homebuyers who secure a mortgage during a period of high rates may have the opportunity to refinance later when rates have dropped, potentially reducing their monthly payments and saving money in the long run.

Locking in a Fixed-Rate Mortgage

When mortgage rates are high, homebuyers may be inclined to lock in a fixed-rate mortgage. This type of mortgage offers stability as the interest rate remains unchanged throughout the loan term. By securing a fixed-rate mortgage during a period of high rates, homebuyers can protect themselves from potential future rate increases. This stability provides peace of mind and predictable monthly payments, regardless of any fluctuations in the mortgage market.

Compare Current Mortgage Rates from Top Lenders

The bottom line

Buying a home during a period of high mortgage rates may appear challenging, but it presents unique opportunities for prospective homebuyers. Reduced buyer competition, more attractive home prices, and the potential for negotiation are among the benefits that can be leveraged in this market. By taking advantage of the current conditions, homebuyers can secure a property at a more affordable price and potentially save in the long run. It is essential to approach the process with careful research, financial planning, and the guidance of real estate professionals to maximize the advantages offered by a high-rate environment.